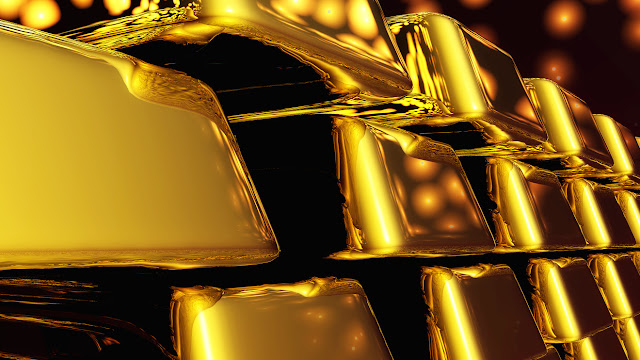

Bullion in reverse gear on Fed rate hike fears

Gold futures fell during noon trade in the domestic market on Tuesday tracking a bearish trend overseas as a stronger dollar curbed the lure for the bullion as an alternative asset. Stronger greenback makes gold more expensive for those holding other currencies, thus dimming demand. Further, robust US economic data bolstered the case for interest rate tightening in September, dimming the lure for the yellow metal as a store of value. US consumer spending climbed for a fourth straight month, up by 0.3 per cent in July from June. At the MCX, gold futures for October 2016 contract is trading at Rs 30,967 per 10 grams, down by 0.35 per cent, after opening at Rs 31,045, against a previous close of Rs 31,075. It touched the intra-day low of Rs 30,962. Register Now For More Profit: